Overview:

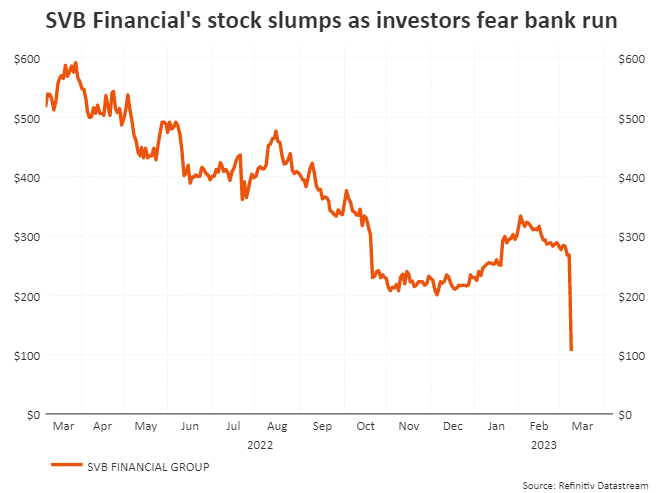

On Thursday, the Silicon Valley Bank struggled to reassure their venture capital clients. The money of the clients is safe after the capital raise. The capital will lead to the stock and collapse by 60% and support wiping out the $80 billion in value from the bank shares.

Silicon Valley Bank introduces shares:

The Silicon Valley Bank introduces a $1.75 billion share sale on Wednesday to shore their balance sheet. This will aid from the investor’s point of view that will need the process to plug the $1.8 billion hole which causes the sale of a $21 billion loss and it makes a bond portfolio. That bond portfolio will consist of most United States Treasuries. The portfolio was buckled with an average of 1.79% returns which is very below the current 10 years Treasury and it is around 3.9%.

Investors of SVB:

The investors in the bank stock are worried about the capital raise that will be sufficient in the given declines in fortunes of many technologies when they startups and the bank serves. The stock of the company collapsed to its lowest level since 2016 and when the market closed the shares flowed another 26% extended trade.

The CEO of Silicon Valley bank recall their clients to make sure that their money in the bank is safe according to the two people that are similar in this matter.

Startups pull their money out of the bank:

Few startups are convincing their founders to pull out their money from Silicon Valley Bank as a safety measure. According to the source, Peter Thiel who is the founder of the fund is included in those people.

There is a startup in San Francisco that pull out all its money from a Silicon Valley bank on Thursday. The funds are shown in the bank accounts of the Startups. They are showing as “Pending” from 4 pm time on Thursday.

According to the source, Silicon Valley Bank told four of their clients that the transfer of money will be delayed and they do not respond to multiple comments now. The crucial lenders for the early-stage businesses in which the SVB is the banking partner for almost half of the US Venture treasury-backed technology. In addition, the bank is also associated with health companies that are listed on the stock market in 2022.

Statement of Silicon Valley Bank CEO:

Becker said in his letter that the Venture Capital deployment is now tracking by our expectations and the client’s cash burns are kept elevated. The client’s cash burn also increased in February which result in a lower deposit as compared to their forecasting.

Positioning for the High Rates:

SVB states that the funds which are increased from the stock sale will be re-invest for the short-term debt. The bank will double it and borrow $30 billion. They said “we are taking such kind of actions because the bank is expecting higher interest rates. The interest will continue in the future. The bank also expects the pressured public and the private markets, and the idealistic cash burn level from our clients.

When the bank will see the return to the balance between the cash burn and venture investment. We have a better position to increase the growth and profitability and there is nothing that SVB is well capitalized.

SVB bank also forecast that the mid-thirties percentage will be declining in the net interest income this year 2023. These are larger as compared to the high teens and it will drop the forecast which is seven weeks earlier.

The stock of the bank will remain under pressure from the risk-off sentiment. There is a question about the systemic risks to the industry according to John Luke Tyner. It will fix the income analyst at Aptus Capital Advisors.

Conclusion:

SVB recently introduced a $1.75 billion share sale to shore up its balance sheet, which causes concerns among its VPC about the safety of its money. The bank’s stock has collapsed by 60%, wiping out $80 billion in value from the bank shares.

You Might Also Like: The Perfect Gaming Rig: A Deep Dive Into Acer Predator Helios 500 17 AMD